Guardian’s Allowance 2020

The Guardian’s Allowance is a weekly payment for raising a child whose parents are no longer living (e.g. orphaned). Furthermore, you may still qualify even if there is a surviving parent.

This allowance for guardians of children is not one of the means-tested welfare allowances. So, the money is tax-free and you would get it in addition to any Child Benefit payments that you are receiving.

Even so, it is important to notify the Guardian’s Allowance Unit if there are any changes to your personal or household circumstances.

Guardian’s Allowance Rate

The current rate for Guardian’s Allowance 2020 is £17.90 per week. The money is usually paid into a secure bank account every four (4) weeks.

But, as a single parent (or someone on a low income) you can also ask to get it paid weekly.

Another section explains how your benefits are paid in greater detail. But, in general the only one you can’t have the money paid into is a Nationwide Building Society account in someone else’s name.

How Does it Affect other Benefits?

The guardians allowance will not count as income for anyone who is already claiming (either):

- Income Support

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance

- Tax credits

Furthermore, the High Income Child Benefit Tax Charge does not affect the payments. So, the allowance can continue even if you choose not to receive Child Benefit.

Eligibility for Guardians Allowance

To qualify for Guardian’s Allowance you must be bringing up someone else’s child, and (all):

- The child’s parents are no longer living (see the rules below if there is a surviving parent)

- You meet the eligibility criteria for Child Benefit 2020

- At least one of the parents was born in the United Kingdom (or living in the UK since the age of sixteen for a period of at least 52 weeks in any two-year period)

You may still qualify for the Guardian’s Allowance even if you are going through the child adoption process. But, it would only apply if you were getting the payment before you decided to adopt.

Rules if there is a Surviving Parent

You could still get the weekly payment for bringing up someone else’s child even if there is one surviving parent. But, to get it, at least one of these must be true:

- You do not know how to find the surviving parent.

- After the parents got divorced (or dissolved a civil partnership) the surviving parent:

- Does not have custody.

- Is not maintaining the child.

- Does not have a court order saying they should.

- The parents were not married, the mother has since died, and the father remains unknown.

- As a result of a court order, the surviving parent has been placed in a hospital.

- The surviving parent is going to be in prison for a period of at least two (2) years from the date that the other parent died.

How to Claim Guardian’s Allowance

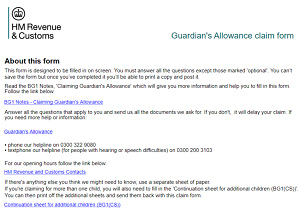

Claiming Guardian’s Allowance is a two step process:

- Use claim form BG1 if you are bringing up a child whose parents have since died (or request a claim pack by phone).

- Fill in the form and send it to the Guardian’s Allowance Unit at HMRC (address below). It is important to send the child’s full birth certificate and the death certificate(s) for the parent(s) (originals).

HM Revenue and Customs (Guardian’s Allowance Unit)

Child Benefit Office

PO Box 1

Newcastle upon Tyne

NE88 1AA

United Kingdom

Telephone: 0300 322 9080

Textphone: 0300 200 3103

Monday to Friday: 8:30am to 4pm

Closed Saturdays, Sundays and bank holidays (2020 calendar)

Despite being able to backdate a claim for up to three (3) months, you should make your claim for the money as soon as the child starts living with you.

Challenge a Decision about Guardian’s Allowance

You need to use a process called ‘mandatory reconsideration‘ if you disagree with a decision. It is the official way of asking the department to take another look at the details and circumstances in your claim.

Changes You Must Report

A change of circumstances usually affects your entitlement to claim the Guardian’s Allowance payment. In fact, in some cases it may stop altogether.

Hence, you need to report changes without delay. But, you can report most of the changes online, such as if:

- The child stops living with you (goes to live with someone else).

- You live overseas of the United Kingdom temporarily (e.g. for more than 8 weeks) or permanently (e.g. for more than one year).

- The child leaves full-time education or approved training.

- You change your bank account or contact details.

- You find out where the surviving parent is.

- The surviving parent leaves hospital or prison (or has their sentence shortened).

- The surviving parent starts making a payment towards the upkeep of their child.