Reporting Changes to HMRC

It’s true that most employees have little need to deal with HM Revenue and Customs. But, when you report changes to HMRC you will reduce the likelihood of missing out on important benefits and tax rebates.

Notify a Change of Name or Address

The easiest way to contact HM Revenue and Customs (HMRC) is online. Even so, your particular situation will determine the best method to update your name or address.

For example, if you are running your own company, you also need to tell HMRC about a change to your business (e.g. to change or update the business records).

To Change Your Address

Most employees will have their salary or pension paid through a system called ‘Pay As You Earn’. As a result, you need to tell HMRC when you change your address if you have your money paid through basic PAYE.

Another way to report changes to HMRC occurs when you submit a Self Assessment tax return. In this case, they will update your details for your income and your pension (if you have one).

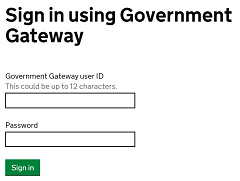

In contrast, you must use a different method (e.g. using Government Gateway) for reporting changes to HMRC if you:

- Only pay your tax through Self Assessment

- Plan on leaving the United Kingdom to live abroad

- Are already living abroad

- Operate as a tax agent (e.g. an accountant)

If You Changed Your Name

Being on payroll (e.g. PAYE) means you need to sign in using Government Gateway to notify HMRC that your name has changed. Submitting a Self Assessment tax return will also update your details.

Unless you already have one you will need to:

- Create a Government Gateway user ID and password

- Get a permanent National Insurance number (not a temporary reference number)

Also, there are different ways of notifying HM Revenue and Customs about a name change if you:

- Only pay your tax through Self Assessment

- Are a tax agent

- Are living overseas of the United Kingdom

The section below explains how changing gender would automatically update a change of name.

How HMRC Update Personal Records

Once you report changes to HMRC they will update their records relating to:

- Income Tax and National Insurance

- Other services (such as the Pension Service)

- Tax credits and other benefits (including Child Benefit)

HM Revenue and Customs (HMRC) will send you an email that will (either):

- Confirm the change to your details

- Request more information (e.g. legal documentation for a name change)

Taxable Income Changes

A change in your taxable income (e.g. the amount of Income Tax you pay) needs reporting to HM Revenue and Customs. You can (either):

- Check your Income Tax for the current year and then go to the HMRC ‘Tell us about a change’ page

- Call the HMRC general enquiries helpline

It’s important to have your National Insurance number (NIno) ready:

Telephone: 0300 200 3300

Outside UK: +44 135 535 9022

Monday to Friday: 8am to 8pm

Saturday: 8am to 4pm

Closed Sunday and bank holidays.

Details You Need to Tell HMRC

Some of the responsibilities of being an employer, or a pension provider, include telling HMRC any time:

- You start a new job or finish one.

- The money you earn from your job or the amount you get from your pension changes.

Furthermore, you must also tell HMRC yourself if there are any other changes. Typical examples include times when you either start or stop getting:

- A new income source (e.g. money as a result of working for yourself or from renting out your property).

- Certain types of benefits through your job (e.g. tax on company cars).

- Income above the current Personal Allowances.

- Income from money, shares, or property you inherit (e.g. dividends from shares, property rental).

- Lump sums realised from selling things liable for Capital Gains Tax (e.g. certain types of property, shares).

- Money over the current threshold earned from self-employment (if so you would need to register for VAT).

- State benefits that are taxable (such as the Carer’s Allowance, Jobseeker’s Allowance, and the State Pension).

If you are getting tax credits:

There is a separate way to report changes that affect your tax credits to HM Revenue and Customs.

If a spouse or civil partner dies:

Also, HMRC need to know when someone dies (e.g. your husband, wife, or civil partner). The UK Rules website (or GOV.UK) explains more about your benefits, tax and pension after the death of a spouse).

If you make ‘payments on account’:

Do you pay your Self Assessment tax bill in advance through ‘payments on account’?. If so, and you are expecting a substantial decrease in income, you need to report changes to HMRC so they can decide whether to reduce your payments.

After You Report Changes to HMRC

Once you tell HMRC about these types of income changes, they may:

- Change the tax codes and send out a PAYE Coding notice.

- Have you send Self Assessment tax returns and bill you for any tax that you owe.

- Send a tax refund if you paid too much.

Notify HMRC about Relationship or Family changes

You will need to inform HM Revenue and Customs (HMRC) about personal changes, such as:

- Getting married or forming a civil partnership.

- Getting divorced, separated or you stop living with your husband, wife, or civil partner.

If your salary or pension is paid through PAYE you will be able to report the changes online. Likewise, submitting a Self Assessment tax return as well means your details will be amended for both.

Unless you already have one you will need to:

- Create a Government Gateway user ID and password. You will be able to create an ID and password when you tell HMRC online.

- Get a permanent National Insurance number (not a temporary reference number).

This is another important reason why you need to know how to report changes to HMRC. Any delay in the notification could mean you end up paying too much tax, or you get an unexpected bill at the end of the tax year.

If you are getting Child Benefit or tax credits:

The UK Rules website (or GOV.UK) explains how to tell HMRC separately about relationship or family changes if you get certain benefits:

If your spouse or civil partner dies:

You can use the ‘Tell Us Once’ service to report the death of your spouse (e.g. husband, wife) or your civil partner. In most cases, losing someone you were living with will change the household income.

Reporting a Gender Change to HMRC

When you apply for a Gender Recognition Certificate (using the legal process) the system usually notifies HM Revenue and Customs (HMRC) that you have changed gender.

It would also be important to tell your employer about the gender change. Your employer will know what to do if an employee changes gender (e.g. update National Insurance contributions and payroll records).

When HM Revenue and Customs receive notification about a gender change they will:

- Update their records to the new gender along with any name change.

- Inform the Department for Work and Pensions (DWP).

- Place a restriction on the records (only specialist staff at DWP and HMRC will be able to access them).

- Hand over the tax affairs to the Public Department 1 at HMRC.

Hence, you should contact them if you have any questions relating to your tax or National Insurance after changing gender:

HMRC

Public Department 1

Ty-Glas

Llanishen

Cardiff

CF14 5QZ

Telephone: 03000 534730

Monday to Friday: 8.30am to 5pm

Information about call charges

Report Changes to HMRC Yourself

You can also tell HMRC yourself by writing to Special Section D. You can include information on:

- Your legal gender change.

- Your name change only (e.g. you did not change gender legally).

- Whether you do not want HMRC to restrict your records.

Remember to include your National Insurance number along with the original Gender Recognition Certificate if you used the legal process to change gender.

HMRC

Special Section D

Room BP9207

Benton Park View

Newcastle upon Tyne

NE98 1ZZ